Energy caps to fall this winter due to lower wholesale costs

- The level of the default price cap, which protects around 11 million default tariff customers, will fall this winter by £75, driven by lower wholesale energy prices

- The level of the pre-payment meter cap falls by £25 for around 4 million customers after its methodology is brought into line with the default price cap

- The caps protect around 15 million customers in total from being overcharged and they can save even more by shopping around

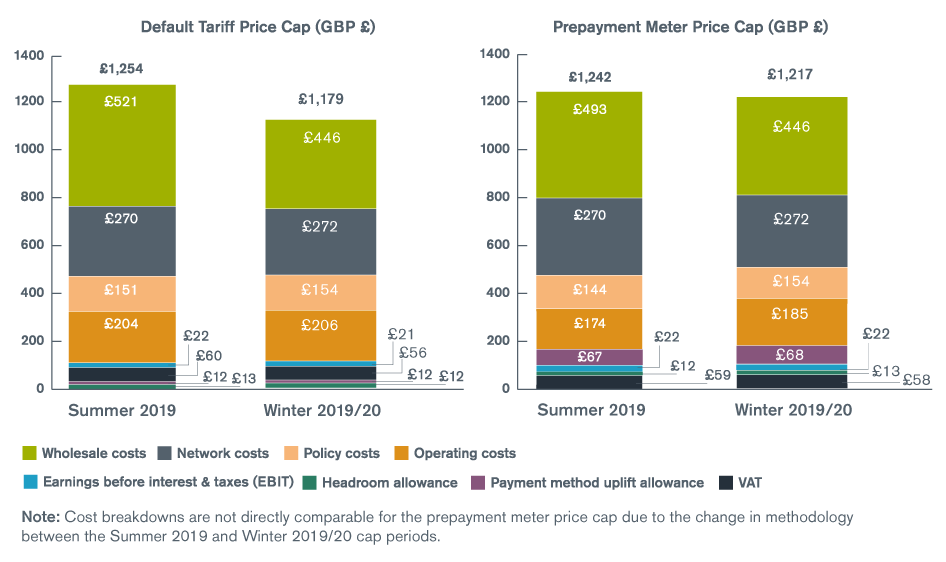

The default price cap is set to fall from £1,254 to £1,179 from 1 October for this winter period (October-March). The pre-payment meter cap will fall from £1,242 to £1,217 per year for the same six month period.

As a result, energy bills will fall this winter for around 15 million households who are protected by the price caps.

Wholesale energy prices have significantly fallen between February and June 2019. A combination of low demand during the winter, strong gas supply and relatively healthy storage levels have pushed down wholesale prices, resulting in the reduction of both caps.

The wholesale energy cost element of the default tariff cap fell by £75 to £446 while other costs, such as VAT and supplier profits, fell slightly.

These reductions offset cost increases totalling £7 of other elements such as operating costs, network charges and environmental schemes, resulting in an overall reduction of £75 in the level of the default tariff cap.

Last month, the Competition and Markets Authority decided to bring the methodology for calculating the pre-payment cap in line with the default cap.

Following this change, the level of the pre-payment meter cap is higher than the default tariff cap. The pre-payment meter cap now fully reflects the higher cost of providing energy to these customers (incurred by operating pre-pay keys and cards used to top up pre-payment meters).

Dermot Nolan, chief executive of Ofgem, said:

“The price caps require suppliers to pass on any savings to customers when their cost to supply electricity and gas falls.

“This means the energy bills of around 15 million customers on default deals or pre-payment meters will fall this winter to reflect the reduction in cost of the wholesale energy.

“These customers can be confident that whatever happens, the price they pay for their energy reflects the costs of supplying it.

“Households can cut their bills further in time for winter, and we would encourage all customers to shop around to get themselves the best deal possible for their energy.”

Note: cost breakdowns above do not add up exactly to total cap levels due to rounding effect.

Notes to editors

1. The default tariff price cap, which was introduced on 1 January 2019, protects around 11 million households on default, including standard variable, tariffs. The pre-payment meter price cap, which was introduced on 1 April 2017, protects around 4 million households who pre-pay for their energy.

2. The price caps are a cap on a unit of gas and electricity, with standing charges taken into account. They are not a cap on customers’ overall energy bills, which will still rise or fall in line with their energy consumption.

3. Ofgem calculates the level of the prepayment price cap following the Competition and Markets Authority’s (CMA) methodology. In July 2019, the CMA revised the methodology, to better reflect the costs incurred in delivering energy services to prepayment customers. From 1 October 2019, the prepayment meter price cap methodology now aligns more closely with our methodology for the default tariff price cap.

4. Ofgem has decided to include a full Capacity Market allowance in the upcoming winter price cap period (the Capacity Market is a government scheme which is designed to ensure electricity security of supply). We followed the same approach for the current summer 2019 price cap period. This decision reflects the government’s intention, subject to the European Commission’s State Aid decision, to make suspended payments to capacity providers, and its expectation that suppliers would pay these costs. We consider it would be reasonable for suppliers to collect these costs from their customers, including those on default tariffs. In the event that the European Commission does not provide State Aid approval for deferred payments, we expect suppliers to reimburse customers, and we would consult on the best way to ensure this.

5. Ofgem has confirmed today that it has set the smart metering allowance in the winter price cap period using the same methodology as in previous price cap periods. In April this year, Ofgem announced that it would review its methodology for smart metering costs in the default tariff cap. We expect to consult on a new methodology later this year.

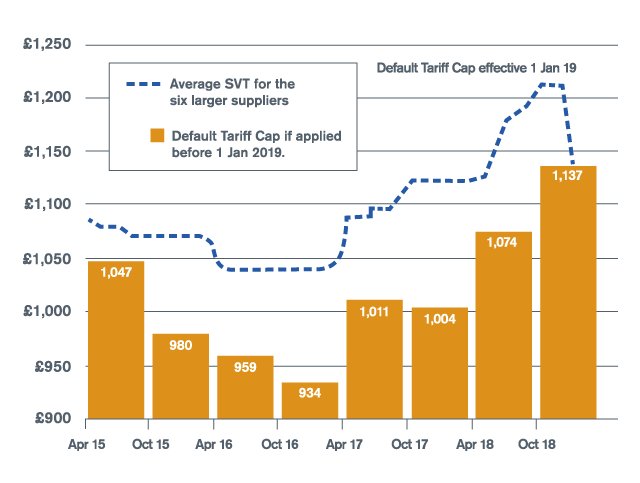

6. Ofgem analysis at the time the default tariff cap was introduced suggests that the default tariff price cap would have reduced the price of the average standard variable tariffs from the six largest suppliers by around £75 to £100 per year since April 2015 had it been in place over this period. The chart below shows these suppliers have consistently charged more than the indicative level of the default tariff cap, which reflects the estimated costs of an efficient supplier. This analysis suggests had the cap not been introduced on 1 January, customers would be paying significantly more. However, it is impossible to estimate an exact savings figure going forward as suppliers can no longer price above the level of the cap.

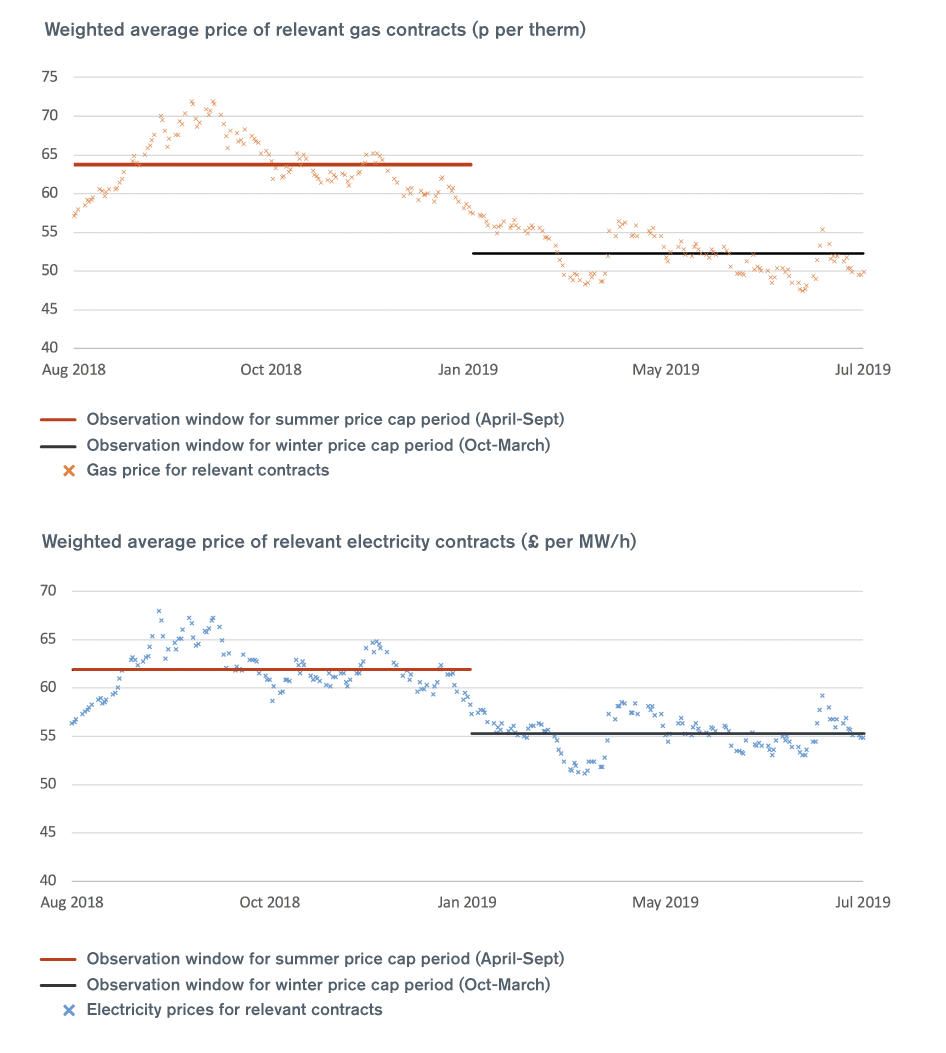

7. Suppliers buy electricity and gas on the wholesale markets in advance, purchasing ‘forward contracts’ gradually over time. The default tariff price reflects suppliers’ costs because we use the wholesale prices of the relevant forward contracts that were sold in advance during an ‘observation window’ before each 6 month price cap period. The observation window for the winter price cap period (October – March) is the previous January - July. The observation window for the summer price cap period (November - April) is the previous August - January. The graphs below show a) how wholesale gas and electricity prices for the relevant contracts on offer in each observation window result in an allowance that reflects suppliers’ average costs:

8. The price cap levels represent a dual fuel customer paying by direct debit who uses a typical amount of gas and electricity, using a measure called Typical Domestic Consumption Values for a medium gas user and medium electricity user.

9. From 1 October the per unit level of the default price cap to the nearest pence (figures for pre-payment meter price cap in brackets) for a typical customer paying by direct debit will be 18p per kWh (18p per kWh) for electricity customers and 4p per kWh (4p per kWh) for gas customers.

10. Information and materials for consumers about the price caps is available at: www.ofgem.gov.uk/energy-price-caps

For media, contact

Michelle Amos: 020 7901 1881

Media out of hours mobile: 07766 511470 (media calls only)

General enquiries (non-media)

If you are an energy customer looking for help and advice, including complaints about energy firms, please see our Household gas and electricity guide. Citizens Advice also provide a free, impartial helpline service across a range of issues on 03454 040506.

We also regularly share news and post general advice to help consumers get the most out of their energy services via our @Ofgem twitter and Facebook pages.If you have an enquiry or complaint relating to Ofgem’s policies or functions, contact us at consumeraffairs@ofgem.gov.uk or on 020 7901 7295.

For all other non-media related enquiries, please visit our Contact us page.

About Ofgem

Ofgem is the independent energy regulator for Great Britain. Its priority is to make a positive difference for consumers by promoting competition in the energy markets and regulating networks.

For facts, figures and information about Ofgem’s work, see Energy facts and figuresor visit the Ofgem Data Portal.

For energy insights and updates straight to your inbox from Ofgem, please subscribe.