Increased wholesale energy costs lead to rise in price cap

- Publication type:

- Press release

- Publication date:

- Topic:

- Gas supply, Energy pricing rules

- Subtopic:

- Energy price cap

Energy regulator Ofgem has today (Thursday 23 November, 2023) announced the energy price cap for the first quarter of 2024.

The price cap will increase by 5% on the previous quarter from 1 January to 31 March 2024. For an average household paying by direct debit for dual fuel this equates to £1,928, a rise of £94 over the course of a year - around £7.83 a month. The price cap, updated every quarter, sets a maximum that can be charged to customers for energy bills.

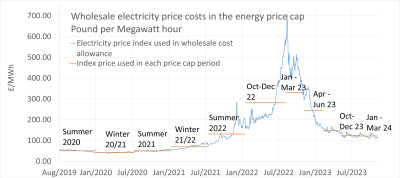

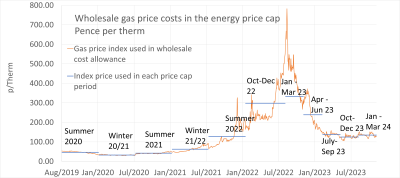

Ofgem’s priority is to protect consumers and ensure that they pay a fair price for their energy. Today’s price increase is driven almost entirely by rising costs in the international wholesale energy market due to market instability and global events, particularly the conflict in Ukraine.

The regulator will continue to use all levers available to ensure costs are spread fairly and customers struggling with bills are supported. It has today further developed plans to permanently remove the so-called ‘prepayment meter premium’ to ensure that prepayment customers are charged the same standing charge as direct debit customers. Ofgem has already launched a ‘Call for Input’ on standing charges running until 19 January, 2024.

Jonathan Brearley, CEO of Ofgem, said:

“This is a difficult time for many people, and any increase in bills will be worrying. But this rise – around the levels we saw in August – is a result of the wholesale cost of gas and electricity rising, which needs to be reflected in the price that we all pay.

“It is important that customers are supported and we have made clear to suppliers that we expect them to identify and offer help to those who are struggling with bills.

“We are also seeing the return of choice to the market, which is a positive sign and customers could benefit from shopping around with a range of tariffs now available offering the security of a fixed rate or a more flexible deal that tracks below the price cap.

“People should weigh up all the information, seek independent advice from trusted sources and consider what is most important for them whether that’s the lowest price or the security of a fixed deal.”

Ofgem recently set out new rules for suppliers making clear that they should be prioritising enquiries from vulnerable customers who need help and proactively reaching out to households if they miss two monthly or one quarterly payment, check to see if they are struggling with bills and, if so, offer support such as affordable payment plans or, if appropriate, repayment holidays.

The regulator has also taken robust action to raise standards of customer service and worked in conjunction with suppliers and consumer groups to encourage industry to support those struggling with their bills, including the Winter 2023 Voluntary Debt Commitment recently announced by Energy UK and Citizens Advice.

A Statutory Consultation on levelling standing charges for prepayment meter and direct debit customers so customers pay the same daily charge has been published today.

Previously, customers on prepayment have been charged more than those who pay by direct debit to cover the additional costs and resources required by suppliers to provide their services.

In October 2022, the government introduced measures to temporarily remove this ‘PPM premium’ via the Energy Price Guarantee, which remains in place until April 2024.

Following a consultation this summer, Ofgem is now proposing an enduring solution that would ‘levelise’ these standing charges to coincide with the end of that government support. This consultation also sets out proposals to share the costs of bad debt more equally across customers to reduce the premium paid by standard credit customers (those who pay on receipt of a monthly or quarterly bill for the exact amount of energy used).

Under the terms of the regulator's proposal, this would save PPM customers around £50 a year, reduce Standard Credit bills by around £45 a year but add around £20 a year for direct debit customers. Ofgem is keen to hear views on this proposal from all interested parties.

This follows the launch of a wider conversation on the issue of standing charges last week and how they should be set, which has already attracted a high number of responses in the first week of the consultation.

The next quarterly price cap announcement will be announced in February 2024, covering April – June 2024.

NOTES TO EDITORS

Help with bills, money saving tips and how to find out more about the Priority Services Register can all be found on the Ofgem Energy Aware website - Get help if you cannot afford your energy bills | Ofgem.

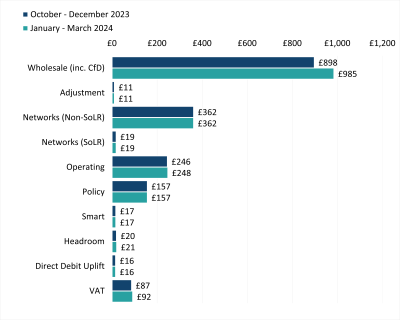

Comparison of current price cap rate to prices from January 1, 2024:

The energy price cap was introduced by the government and has been in place since January 2019, and Ofgem is required to regularly review the level at which it is set. It ensures that an energy supplier can recoup its efficient costs while making sure customers do not pay a higher amount for their energy than they should. The price cap, as set out in law, does this by setting a maximum that suppliers can charge per unit of energy.

Statutory Consultation on changes to prepayment meter standing charges and other debt related costs.

Ofgem's priority is to protect consumers. Ofgem has been working throughout the year to help make sure consumers stay warm, on power, and on top of their bills this winter. This includes increasing crisis credit allowance for struggling PPM customers, trebling storm power cut compensation, and making sure suppliers offer debt repayment plans at earliest possible opportunity and consider payment holidays.

Earlier this year, Ofgem chief executive Jonathan Brearley wrote to energy suppliers setting out clear expectations on financial resilience and supporting consumers, including the overarching principle that companies must use profits to improve their capital position before paying dividends to shareholders.

The letter also warned that the regulator is closely monitoring levels of customer service, support and financial adequacy – and can, and will, act where suppliers are found lacking.

Ofgem has robust rules in place to help people in vulnerable situations, and suppliers are obliged to offer payment plans and direct customers to available support.

The regulator has made it clear to suppliers that improving customer service standards must be a priority, as outlined the recent consumer standards decision.

Updated number of customers on different tariff types as of September* 2023

- New no. of customers on SVTs – ‘around 29 million’

- New no. of SVT (non-PPM) customers – ‘around 25 million’

- New no. of SVT PPM customers – ‘around 4 million’

- Total number of customers on fixed tariffs: 'around 3 million' (with the vast majority being non-PPM)

* Latest Financial Responsibility RFI data is for September-23. Tariff and Customer Account RFI data is as of October-23 (used to calculate the SVT payment splits).)

The tariff cap was legislated by government in order to protect default tariff customers (i.e. those on standard tariffs) from being overcharged. Price cap updates are currently published on a quarterly basis. More information on this can be found on the "Ofgem confirms changes to the price cap methodology and frequency ahead of new rate to be announced later this month" press release.

The price cap level is based on typical use for an average household and is a cap on energy unit price not a cap on total bills. For an individual customer, the amount they will pay varies depending on how much energy they use, where they live, and how they pay for their energy.

The methodology for setting the price cap is set out here and is regularly reviewed by Ofgem:

Default tariff cap: decision - overview | Ofgem

Price cap - Decision on changes to the wholesale methodology | Ofgem

Published cap levels for the charge restriction period 11b of the default tariff cap: 1 Jan 2024 – 31 Mar 2024:

The price cap protects around 29 million customers on default or variable rates. The £1,928 per year level of the cap is based on a household with typical consumption (2023 TDCV) on a dual fuel electricity and gas bill paying by direct debit. On 1 October 2023 Ofgem updated its TDCV figures from the previous (2019) TDCVs. The equivalent price cap level in previous (2019) TDCV is £2,023. You can find more about our 2023 TDCV decision

For customers who pay by standard credit (cash or cheque), the default cap has increased by £99 from £1,959 to £2,058 for typical dual fuel consumption. The additional costs reflect the higher cost for energy companies to serve them.

The 29 million customers protected by the price cap includes around 4 million prepayment meter (PPM) customers. The PPM level of the default cap has increased by £99 from £1,861 to £1,960 for average dual fuel consumption. The additional costs for PPM customers reflects the higher cost for energy companies to serve them. For electricity only customers on Economy 7 paying by Direct Debit has increased by £53 from £1,219 to £1,272 for typical consumption (3,900 kWh).

Breakdown of costs in the energy price cap

Wholesale cost graph for electricity

Wholesale cost graphs for gas