Has the wholesale power market become more liquid?

It goes without saying that there has been a lot of focus on the retail side of the GB energy market – and rightly so. The CMA’s investigation confirmed that two thirds of households are disengaged and paying over the odds for energy compared to those who have switched tariff. We will implement the CMA’s remedies to make the market fairer and more competitive for all consumers.

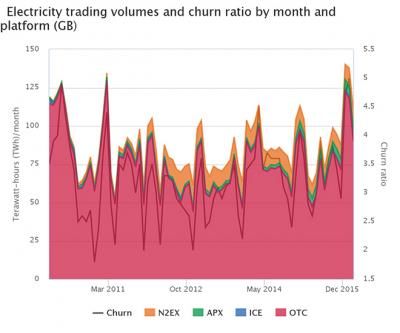

However, for the GB market to be competitive suppliers and generators also need to be confident that they can buy and sell wholesale energy at a fair price. We keep a close eye on the GB wholesale markets and overall we’ve found that on the gas side the wholesale energy market is competitive and outperforms virtually all relevant European and US benchmarks. The electricity side is reasonably competitive, but over the past few years it has been clear that liquidity needs to improve.

What is liquidity?

Liquidity means being able to quickly buy and sell electricity without changing the market price significantly, and without it being too costly. In a liquid market you usually have lots of suppliers and generators willing to trade electricity. Liquid markets are important because they ensure prices are accurate and reflect the market value, which means energy consumers are better off too.

From 2002 onwards liquidity started to fall in GB after Enron, the collapsed energy trading group, and other large companies left the market. The global financial crisis in 2009 didn’t help either, with banks and hedge funds finding it less attractive to trade electricity.

Ofgem’s reforms

Low liquidity was a barrier to small and medium sized suppliers and independent generators entering the market to challenge the six largest suppliers. So in March 2014 we introduced rules requiring the six largest suppliers and the two largest generators to trade fairly with smaller suppliers. At certain times of the day the six largest suppliers must also post the prices at which they will trade wholesale power up to two years in advance.

These reforms aim to improve liquidity and encourage a well-functioning, competitive market. This benefits customers through downward pressure on bills and a greater choice of suppliers.

We keep a close check on progress and the reforms have made it easier for small and medium sized suppliers and independent generators to buy and sell in advance. We now have a record number of 37 small and medium sized suppliers, so the ability for them to trade power is more important than ever.

What the latest report shows

Our latest liquidity report shows that smaller suppliers have been buying more, and that overall, prices are more robust. This has improved trust in the prices provided by the large companies. Many smaller suppliers have told us that it’s now easier for them to buy wholesale power products and that they are given enough information and clear terms on how to trade.

Source: Ofgem Data Portal - Wholesale Energy Market Indicators

Overall we have found that liquidity has improved since 2014, despite a fall over the middle two quarters of 2015 when prices and market activity were low. Trends such as relatively higher churn (the number of times electricity is traded before being used) and falling bid-offer spreads (the difference in prices generators will sell power at and how much suppliers will pay) showed that liquidity was improving. The near-term market (where electricity is traded for more immediate delivery), has remained liquid since our reforms were introduced. And the amount of trading on power exchanges has been increasing.

So overall our reforms are making an impact, but we are keeping things in perspective. Our data only covers two years so far, and many factors could be contributing to the increased market activity we’ve seen. It is hard to separate out the effects of our reforms from these other factors. They include geopolitical events like the Ukraine-Russia gas price dispute, changing prices of the fuels used to generate electricity and perception of risk that prices will change. That said, we are optimistic that our reforms are making a positive difference for consumers. We will keep checking on progress and listening to feedback, especially from independent suppliers.