- Jonathan Whiting

- Publication date

- Industry sector

- Generation and Wholesale Market

Jonathan Whiting, Manager, Wholesale Markets, looks at the data behind our analysis.

At Ofgem we publish lots of data on the wholesale gas and electricity markets. In this blog, I’ll tell you about some of the competition metrics we use when assessing the electricity market. You can read more about our analysis in our Wholesale Energy Markets Report 2016. We look at competition in a number of different ways to give an overall picture of the market.

Market shares show how big a company is relative to the rest of the market. Market concentration shows the extent to which a market is dominated by one or more firms. We also use pivotality analysis, which assesses how important each firm is in meeting electricity demand.

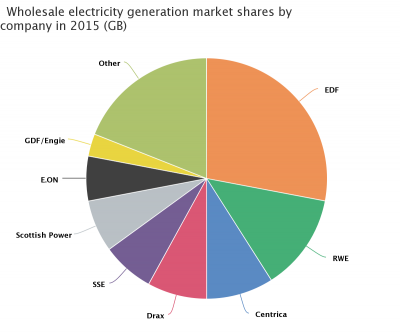

Market shares

EDF Energy had the largest electricity generation market share in 2015, accounting for 28% of total transmission generation, up 2% from the previous year. Overall, the market shares of the major electricity producers are relatively unchanged from 2014; nearly 70% of which is accounted for the by the Big 6. Our analysis suggests that the GB market is relatively stable with a large number of players. There were at least 40 players in 2015, which is positive and implies that market shares are not currently a competition concern. I’ll explain in more depth why this is later on. The market share figures were relatively unchanged from 2014 as we saw little evidence of new entrants joining the market.

You can see the market share indicator here:

Source: Wholesale Market Indicators, Ofgem Data Portal

Market concentration

We analyse market concentration by using the Herfindahl–Hirschman Index (HHI), which is calculated by squaring companies’ market shares and adding up the resulting numbers. This is done to give large companies greater weight, as a large market share owned by one firm could have a negative impact on competition. The less concentrated a market is, the better it is for competition.

When analysing generation output, the wholesale electricity market is concentrated with an HHI of 1267. This is compared to 2014’s HHI of 1243, indicating a slightly more concentrated market in 2015, although the change is not a significant one. A HHI exceeding 1000 is regarded as concentrated and a HHI above 2000 is regarded as very concentrated.

Pivotality analysis

Pivotality analysis considers whether power stations owned by a particular company are required to meet demand in a particular period, ie at least one megawatt of its generation is needed. If this is the case the company could take advantage of this market power. Pivotality only considers the possibility of market power in the market as a whole, and not whether market power can arise in specific situations such as where there are transmission constraints.

Our assessment of the GB market as a whole has shown that there were only 65.5 hours during 2015 where there was a reliance on a particular generator. This means there were very few periods where market power could be exerted. In all instances, once inflexible units, which cannot easily vary their output, are discounted no particular firm was pivotal in any time period. This means that, while some pivotality exists it cannot be acted upon. Overall, metrics show the GB wholesale electricity market competition is fairly stable relative to 2014 levels.

Our analysis suggests a positive picture for competition in the GB market. There are a lot of participants generating electricity, the market concentration is relatively low and companies are unable to exert market power under normal market operation. The CMA also found no evidence that companies are able to exploit market power in the wholesale markets in their final report into the GB energy market. Ofgem keeps a close eye on wholesale markets and has powers to enforce the Regulation on Wholesale Energy Market Integrity and Transparency (REMIT) in GB. Among other things, REMIT specifically prohibits market abuse and therefore acts as a very strong deterrent for companies.